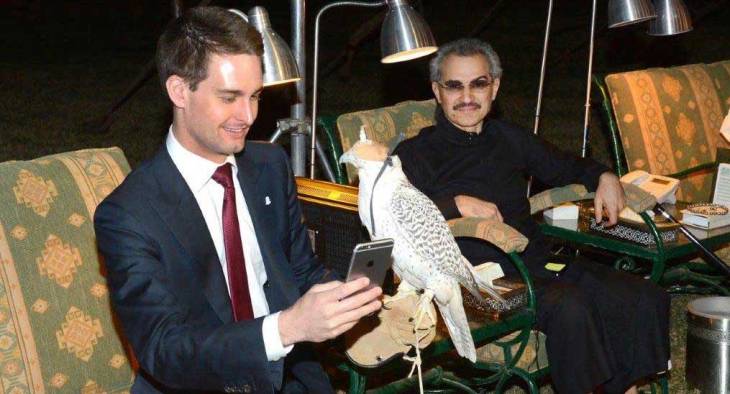

Snap Inc. got a fresh infusion of cash from the Saudi royal family to help it survive despite losing $353 million this quarter. Prince Al-Waleed Talal tweeted a video of him and Snap CEO Evan Spiegel, noting that he’s invested $250 million in exchange for a 2.3 percent stake in Snap Inc. The investment raises questions about what say the Saudis will have in Snapchat’s direction.

The press release details that Al-Waleed bought shares at around $11 each, well below the $13.10 price shares closed at before earnings were released. That means he bought at a valuation around $14 billion, below the $17 billion market cap before earnings dragged down the price to around $15.7 billion. [Correction: Al-Waleed bought at a roughly $14 billion valuation, not $10.8 billion as we originally reported.]