Let’s start with the good news. On a global level, we’re living in the richest, most abundant time in human history. Millions of people have been lifted out of poverty, mainly in Asian countries. And the world looks like it’s moving closer and closer to a sort of Jetsons existence.

But on the way to that idyllic destination, we have a few obstacles to overcome. There’s the ongoing threat of terrorism, Iranian ambition, massive debts. Not to mention automation driven by robotics and artificial intelligence. These four factors are the biggest risks to your finances going forward. And they’re the things most likely to stand between you and a life of financial security.

Terrorism

There are two significant threats to your finances that emanate from terrorism. The first is the direct cost of terrorist acts. Businesses in the immediate area of an incident usually suffer a fall in revenue, at least for a while. And the loss of confidence can undermine the stock exchange. But these aren’t the big effects. The bigger effects come along when people are displaced and when governments tighten controls. These twin effects tend to put pressure on public services, implying higher taxes. And they put stops on trade, meaning it’s harder to expand markets.

Iranian Threat

Mark Dubowitz is the director of the Foundation for Defense of Democracies. He has repeated the warning of the Financial Action Task Force that Iran “represents a severe illicit financial threat.” It’s entirely possible that Iran could, according to the think tank, engage in a sort of financial warfare. All it would have to do to cripple America and the West would be to throw a spanner into the financial works. If it did this, financial panic might set in like it did in 2008. And all Iran would have to do would be to watch as trillions were wiped off US wealth and the economy tanked.

The Debt Bomb

Up until the financial crisis, people were living beyond their means. The recession shocked them a little bit, and they decided it might be a good idea to cut back on spending. Since then, governments around the world have taken over spending. And deficits have grown to historic proportions. The problem is that some day that debt will have to be paid back. And thanks to examples like Greece, that day might not be too far in the future. Paying the debt back will require either higher taxes and/or government spending – bad news for your finances. Or it will simply be inflated away- again, bad news for your finances.

Automation

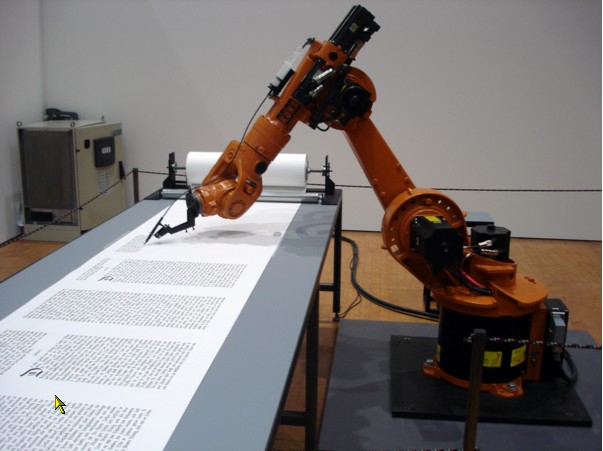

Ever since looms first replaced weavers, people have been warning about the threat of automation. It’ll destroy jobs, they say. But so far that hasn’t happened. Some people, however, believe that AI and robotics are different. They have the potential to eliminate the demand for human labor entirely because they can replicate what humans do. Anybody who relies on a job for income should be concerned. According to some, the robots are coming.