After a year of fighting inflation with rapid rate hikes, central bankers from the world’s wealthiest nations are still struggling with high prices. So far, economies have been resilient in the face of historic rate hikes; while energy and food price growth has slowed in the U.S. and Europe, inflation remains above 5%. “Compounded by central banks having missed the rise of inflation in the first place,” an expert tells The Wall Street Journal, central bankers now face the tough decision of waiting for inflation to come down to their 2% target, or ratcheting rates up even further. The wrong choice could mean inflation sticking around for longer, or a recession.

By Jessy Bains, Editor at LinkedIn News

Is the economy at risk of a recession?

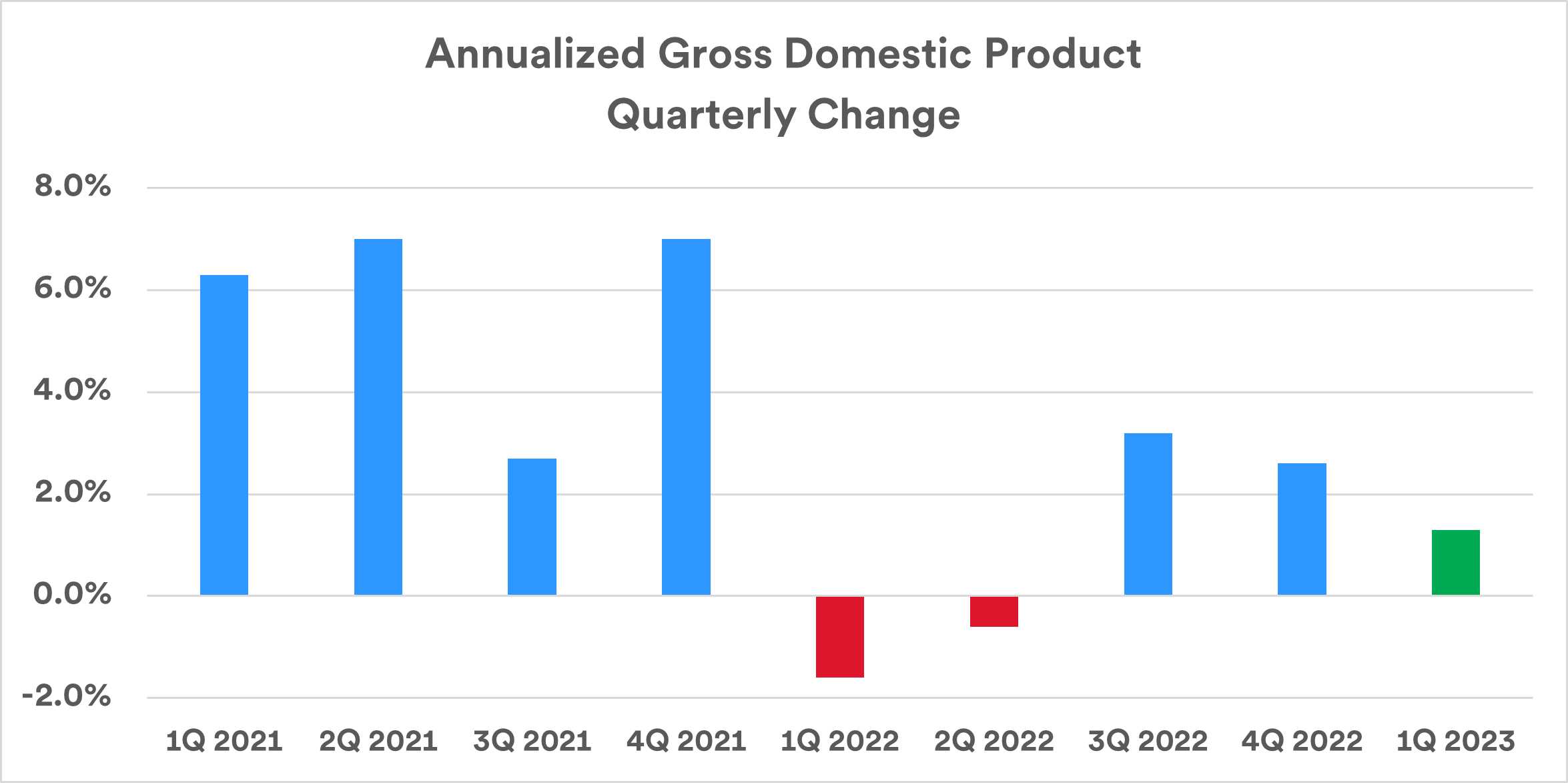

Despite slowing growth this year that some believed would lead to a recession, the U.S. economy continues to expand.

As measured by Gross Domestic Product (GDP) growth, the economy in 2021 expanded at an annualized rate of 5.9%, the fastest rate of growth in a calendar year since 1984. The pace of slowed significantly in 2022, with GDP increasing at a rate of just 2.1%.1 In the first quarter of 2023 (reflected in the green bar on the chart below), GDP growth slowed to a 1.3% annualized rate.2

Recent growth trends raise questions about the direction of the economy going forward. Despite the downward trend in GDP growth, “It’s the continued strength of the consumer that may allow the economy to maintain modestly positive growth this year,” says Rob Haworth, senior investment strategy director at U.S. Bank Wealth Management.

If, however, the economy does slide into a recession in 2023, economist expectations are that it won’t be severe. “Our view is that we’re less concerned with how deep a potential recession is,” says Eric Freedman, chief investment officer at U.S. Bank. “Our bigger concern, if it does occur, is how long it lasts. It’s possible that we see a relatively stagnant economy in the U.S. and Europe in 2023.”

An important contrary indication of a potential recession is the job market, which continues to feature very low unemployment (3.7% in May) and solid job growth.3 In addition, there are significantly more job openings than there are available workers.4

How should investors assess the state of the economy today and what should they expect in the second half of the year?

The impact of inflation’s re-emergence

Beginning in early 2021 and continuing through 2022, there-emergence of inflammation became the biggest economic story. The inflation rate, as measured by the Consumer Price Index (CPI), peaked in June 2022 at more than 9% over the previous 12-month period.5 This was the highest level in more than four decades and exceeds by a wide margin the inflation target established by the Fed. In the closing months of 2022, the inflation rate slowed, and as of April 2023, stood at 4.9% over the previous 12-month period.5 The Fed targets an inflation rate that averages close to 2% over time.

“The Fed has made clear its first target is to soften inflation.”

–Rob Haworth, senior investment strategy director at U.S. Bank Wealth Management

In response, the Fed pivoted its strategy. In March 2022, it raised the primary interest rate it controls, the fed funds rate, for the first time since 2018. By May 2023, the Fed hiked the target funds rate to a range of 5.00% – 5.25%, up from near zero percent before rate hikes began. The Fed also ended its bond buying program and began reducing its bong holdings. They leveraged these strategies to push interest rates higher in the broader bond market and raise borrowing costs to temper the pace of economic growth. “The Fed has made clear its first target is to soften inflation,” says Haworth. “Core inflation (living costs excluding the volatile food and energy sectors) is showing little improvement in the most recent reports, indicating the Fed may have to remain patient and maintain higher interest rates for an extended period of time,” says Haworth.

Today’s higher interest rate environment

The Fed’s aggressive interest rate hikes have had an immediate impact. Yields on many types of fixed income vehicles (certificates of deposit, money market funds, bonds) rose in conjunction with Fed rate hikes. Mortgage rates and interest charged on other types of loans moved up as well.

Higher rates had their greatest impact on areas of the economy that interest rates most directly affect. For example, housing activity has slowed due to increasing mortgage rates. Haworth says other factors to watch include the potential for consumer and business borrowing to slow given higher loan costs attributable to rising interest rates.

Despite the Fed tightening monetary policy since March 2022, job growth exceeded projections, averaging close to 400,000 per month for all of 2022.5 Job growth reports were also solid in the first five months of 2023, though new job creation slowed over that time. “What the Fed is most focused on is wage growth and its impact on the overall inflation rate,” says Haworth. Average hourly earnings rose modestly in 2022 but did not keep pace with the elevated inflation rate. Trends show wage gains moving modestly lower so far in 2023.

In March 2023, reports surfaced detailing the failures of a few regional banks. While it led to concerns about Financial sector stability, fears of a wider contagion among other financial institutions appear to be receding.

Can the economy hold its ground?

A key question is whether the Fed’s aggressive posture allows it to successfully tackle the inflation threat while steering the economy toward a “soft landing” and avoiding a recession.

“It seems likely the economy may stay out of a recession, but we expect that real GDP growth will be relatively flat in the near term,” says Matt Schoeppner, senior economist at U.S. Bank. “It might qualify as what we call a ‘growth recession,’ where we see a slow economy, but with few ramifications for the job market.” Schoeppner says to this point, the economy has demonstrated surprising strength despite the Fed’s efforts to temper growth. “Growth in consumer spending was relatively steady throughout 2022 and ticked up in the first quarter of 2023 when compared to the closing quarter of 2022,” says Schoeppner.

Implications for investors

Both stock and bond markets experienced negative returns in 2022. As the Fed laid out its planned policy shift in early 2022 (raising interest rates and ending its sizable bond purchasing activity), investors became more cautious. “When the Fed says they’re going to raise rates, generally other asset classes will reprice lower in response,” says Freedman.

Interest rates across the board in the bond market moved up rapidly in 2022. While bond yields leveled off after financial sector questions emerged, interest rates remain elevated from where they started in early 2022. Persistently higher rates may continue to put pressure on equity markets. “If investors can earn higher yields now than they did prior to the Fed’s policy shift, it makes stocks less attractive,” says Haworth. “It creates more competition for stocks, which may contribute to ongoing market volatility, says Haworth.

Nevertheless, stocks started 2023 on a positive note. The Standard & Poor’s 500 Index of large-cap stocks generated a total return of 9.6% in the first five months of 2023.

Haworth believes there is potential for Corporate earnings to retreat relative to previous projections, reflecting the impact of slower economic activity and higher borrowing costs for companies. He notes that earnings are taking on greater importance for stock investors, with less apparent concern about issues like Fed rate hikes and ongoing inflation. The subdued earnings forecast is one reason for a cautious, near-term outlook for stocks. In addition, Haworth says the job market may be a bellwether for the direction of the economy. “If that starts to weaken, it may mean the economy is about to face more headwinds.”

Consider reviewing your current portfolio with your wealth management professional l to determine if it’s consistent with your long-term goals and positioned to meet the challenges of what continues to be an uncertain market and economic environment.