At some point or another, you are going to buy a car and unless you have a large chunk of cash lying around, you most likely will have to get a car loan to finance this car purchase. As many of you should know, whenever you take out a loan, there is interest that is accumulated on that loan. Because the math may be a little more difficult than the basic mechanics of a car, I am going to help you understand how to calculate the interest on the car loan.

First, you should know the principal amount. This would be the total borrowed amount. This would be the purchase price of the vehicle minus any rebates (incentive to buy), cash paid down on the car, and trade-in value for the car you are replacing. The principal typically also includes the fees and taxes applied to the vehicle purchase. Say for example, you purchase a care for $12,000 and put down a $3,000 down payment (and let’s pretend in imaginary land that there are no taxes for fees to make this math easier), the principal would be $9,000.

Next, you would want to determine the term of your loan. This is typically around 5 or 6 years. The longer the term, the more interest that you are likely to pay.

Next, you would need to determine the interest rate on the loan. This is typically determined by the finance company and is decided based on your credit score. If you have a higher credit score, you are typically provided with a lower interest rate and if you have a lower credit score, you are typically provided with a higher rate. For car loans, the interest rate is usually referred to as the annual percentage rate (APR). Your interest rate multiplied by the outstanding principal amount in the interest amount owed for a particular period of time. For example, say that we want to calculate the monthly interest for our $9,000 principal payment with an APR of 6%. You would divide the APR by 12 months – 6%/12 = 0.5%. You would then multiply $9,000 x 0.005 = $45. This means that interest on the loan for the first month would be $45. Every month thereafter should have a lower interest payment as the loan is paid down.

The easiest way to calculate the total interest over the lifetime of the loan would be to use a simple online auto loan calculator. Here is a simple one that is easy to use: (http://www.bankrate.com/calculators/auto/auto-loan-calculator.aspx).

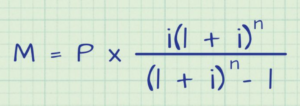

If you are a bit more old school and would like to use your own math skills, here is the formula for computing simple interest: M = P x (i(l + i)n /(l + i) n – 1) See graph above.

“M” would be your month payment. “P” is your principal amount ($9,000). Once again, this is the borrowing amount with all fees and taxes minus rebates, down payments, and trade-in value. “n” is the total number of monthly payments over the lifetime of the loan (72 months), which is the amount of years multiplied by 12. “i” would be your monthly interest rate (0.05% or 0.005), which is your APR divided by 12. Then you do the simple calculations to determine the final total.

In our case, the month total would end up being $149. If you then multiply it by the total number of months of the loan (72), you end up with a loan total of $10,728. If you subtract the original principal from this, you end up with the total interest paid over the life of the loan. $10,728 – $9,000 = $1,728.

To help you save some money, you can take a defensive driving course for a car insurance discount. To help you when purchasing your next vehicle you can take this article with you to the car dealership.