Mistakes To Avoid While Investing In Startups

If you’re tired of investing in the usual securities, betting on some start up stocks is a good way to change things up a bit. Although a high-risk enterprise, investing in startups can be rewarding in the long-run—imagine buying a part of Apple in the 70s.

But before you’re all ready to jump on the startup bandwagon, there are a couple of factors that you need to consider.

Here’s what you shouldn’t be doing while making startup investments:To Understand Your Returns

When you’re investing in a startup, you need to understand exactly what you’re getting in return. Is it an equity investment, where you purchase shares of the company’s ownership? Or will you get a convertible note instead? If so, you need to also take into account the date on which you can cash in your investment or convert it to equity.

Sometimes, investors cannot sell or buy the equity stake they hold in certain startups for several years; their investments then end up becoming long-term holdings. Such an eventuality will turn out to be pleasant only if you have prior knowledge.

You need to be fully aware of what you’re getting into. Like they say, it’s better to be sure rather than to be sorry.Flunking The Class On Future Changes

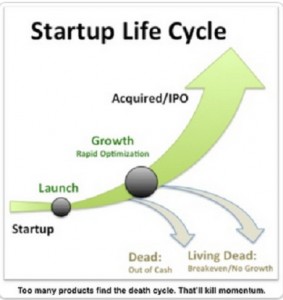

Buying a part of your chosen startup is just one part of the investment process. What comes next is how you end up making profit from it. You need to find out what the company has planned for its shareholders in the future. Are they going to launch an IPO sometime? What happens then? Are you going to receive any dividends at all?

And that’s just the beginning. You also need to assess your voting rights in the company, and find out whether your ownership percentage can be diluted or not.

Source: www.marketchi.com

It’s not just the company’s future you need to look into, you also have to effectively gauge and forecast market trends. For instance, a company that relies heavily on a new technology may go out of business if a better technology is created in the future.

Remember, the liquidity levels of startup stocks are almost always low in the first couple of years. So, you need to make careful long-term plans in order to stay on top. You also need to be aware of how funding works in case of startups.The Allure Of Alien Sectors

As an investor, it’s essential that you stick to what you know. Say a lawyer finds out about the brilliant prospects offered by startups in the animation and gaming industry. She loves the idea and immediately decides to invest. But then she finds out about her glaring lack of knowledge—she doesn’t even know what rigging and modeling are, two of the most basic terms in 3D animation. If she still decides to invest, she’ll just be shooting arrows in the dark; her chances of making a profit will be drastically diminished.

In the last decade tech start-ups have yielded very good returns, especially for the early investors. Who would have thought that companies like Google, Amazon, Facebook, and Netflix etc. would turn out to be so big!Facebook has changed the way people interact socially while Netflix has changed the way people consume content and has led to the first major disruption of TV. Facebook has resulted in good returns for investors as is evident from Facebook stock price history and so has Netflix. However, not all understand these tech companies and the famous Warren Buffett himself has stayed away from tech stocks before taking the plunge with IBM.

Source: smallbusinessplanned.com

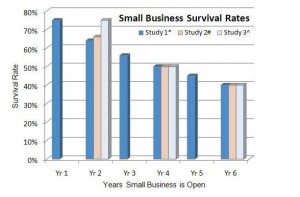

In a recent study, the failure rate of tech startups in Silicon Valley was estimated at a disconcerting 90%. This means that if you don’t have a relevant tech background, you should stay away from investing in a technology startup.

Ideally, you should be allocating only 10-15% of your investment portfolio to startup equities. This way, even if all your startups go bust, you have other trusty investments to back you up.