Most of the money Congress is sending out through stimulus checks will go straight into the bank, and stay there a while.

A group of economists tracking recovery spending estimates that Americans receiving $1,400 checks from the American Rescue Plan due to pass this week will spend no more than one-fourth of it in the first month. And there will be big differences in spending by income group, assuming spending patterns are similar to trends when the last batch of checks arrived in early January.

Researchers at Harvard University’s Opportunity Insights project expect households with income above $78,000 to spend just 7% of the $1,400 they get, or $98. Lower-income households will spend about 21% of the cash, or $294. Middle-income families will spend 15% to 23% of the money, ranging from $90 to $140.

The wealthiest families won’t get stimulus checks. The American Rescue Plan limits full $1,400 payouts to individuals earning up to $75,000 per year and married couples earning $150,000. The payments quickly phase out after that, going to 0 above $80,000 for an individual and $160,000 for a married couple. Dependent children qualify too, however, so a family of four with household income of $150,000 or less would get $5,600.

The American Rescue Plan is controversial for its huge $1.9 trillion price tag and the amount of money it’s injecting into the economy as signs of a recovery are mounting. Some economists, such as former Treasury Secretary Larry Summers, think it’s too much stimulus. Their argument is that stimulus money will fuel a surge of spending in coming months that will stoke inflation, possibly forcing the Federal Reserve to raise short-term interest rates sooner than expected, which could choke off the recovery prematurely.

Consumers have the money to splurge. There’s been an explosion in savings since last March, when the coronavirus struck, from $2.1 trillion in total household savings to $3.9 trillion. Consumers aren’t spending for two reasons. Some people’s incomes have been hammered by job loss or a cutback in hours. There are many others, however, with stable incomes who simply have less to spend it on, since dining, in-person services and travel are greatly curtailed.

As more people get vaccinated and activity returns to normal, consumers are likely to draw down some of that savings, leading to a boom many economists expect later this year. If demand for goods and services significantly exceeds supply, inflation could rise past the Federal Reserve’s 2% target. That’s a concern, reflected in the recent rise in bond and interest rates, as investors price in stronger growth and inflation expectations.

President Biden, however, insists it’s better to do too much than too little. Data backs him up. “The recession has ended for high-wage Americans,” says economist Michael Stepner of the Opportunity Insights project. “For lower-income Americans, the employment recovery has stalled and many people have been out of work continually. Other people are cycling in and out of the labor force. There are certainly lots of low-income folks who need help, plus some in the middle.”

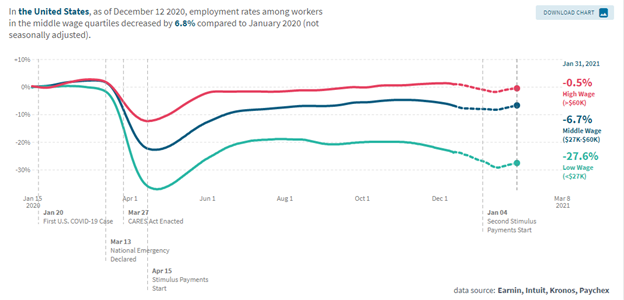

The OI data, for instance, shows that high-wage employment levels are nearly back to pre-pandemic levels, as the following chart shows. Middle-wage employment is still 6.7% below prior levels, with low-wage employment 27.6% lower. That’s a huge hole.

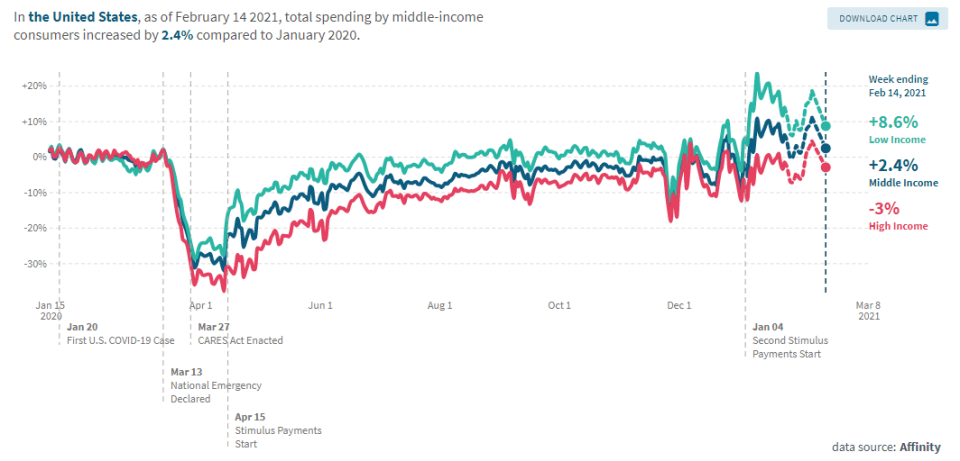

The numbers also show something puzzling, on the surface: Spending is 8.6% higher than before the pandemic for low-income people, and 2.4% higher for middle-income Americans, as shown below. But it’s 3% lower for high-income people. That suggests low-income people have more money to spend, and vice versa.

Spending trends around the distribution of stimulus checks so far—which took place last March and this January—tell the real story, however. Right after those checks went out, low-income spending jumped. Middle-income spending rose by less, and high-income spending barely budged. That strongly suggests low-income people need the stimulus money to get by day-to-day, while higher-income households barely need it at all.

Opportunity Insight economists briefed members of Congress on those findings earlier this year, and Congress ended up lowering the income threshold for people receiving stimulus checks. The January checks phased out at income levels of $87,000 for an individual and $174,000 for a couple. In the latest bill, the income limits fell to $80,000 and $160,000, an acknowledgement that above those levels there was little need for the money, on average.

Lower-income people who save some of their stimulus money aren’t necessarily banking it for a fancy trip when the pandemic’s over. Many people struggling to pay rent or a mortgage are trying to stretch the money as far as they can, aware that Congress won’t be handing out money forever. This may be the last check Congress sends out for a while, with other benefits tapering off into 2022, when the recovery is supposed to be getting into gear.