Tesla earned a profit of $104 million in the second quarter of 2020

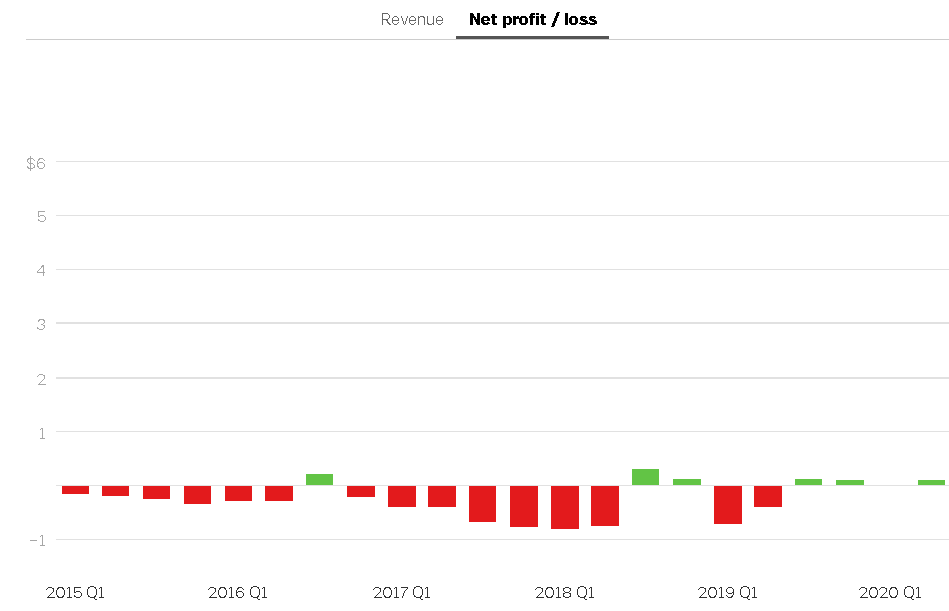

Tesla turned a profit of $104 million in the second quarter of 2020 despite shutting down its electric vehicle factory in Fremont, California, for roughly seven weeks because of the COVID-19 pandemic. As a result, Tesla has now been profitable for four straight quarters for the first time in company history — an elusive benchmark the company has long sought.

But perhaps more importantly, Tesla says it has a “site selected” for its next Gigafactory in the US. During a call with investors, Tesla CEO Elon Musk announced the factory would be located in Austin, Texas. He described it as an “ecological paradise… with birds in the trees, butterflies, fish in the stream.” The factory will also be open to the public, he said.

The company is on track to receive several tax incentive packages from local authorities in Austin, Texas, though it had also been in talks with Tulsa, Oklahoma. Tesla will use the facility to build the Cybertruck and more Model Y SUVs. “We’re going to be doing a major, major factory there,” Musk said.

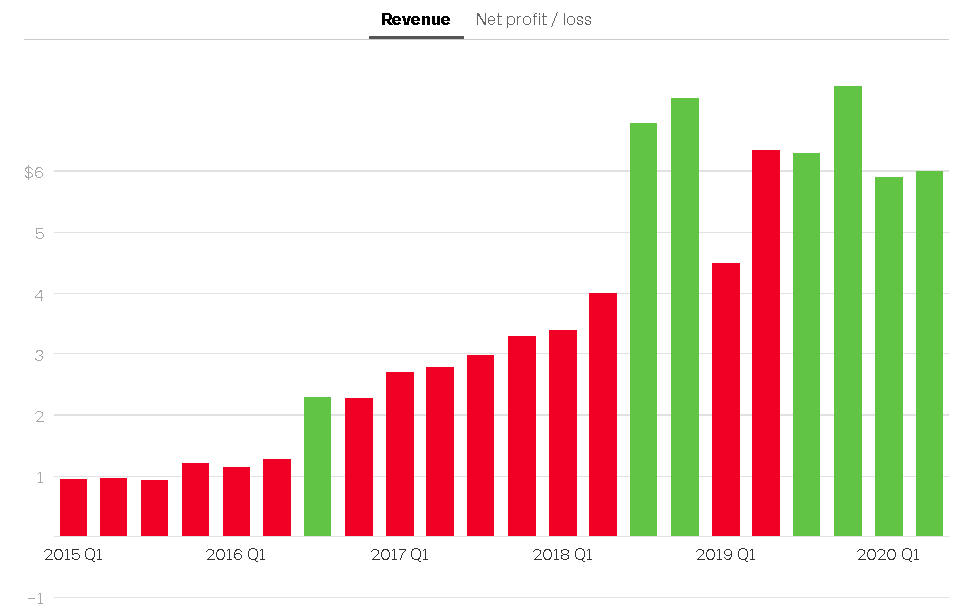

Tesla kept its finances in the black by selling 90,650 vehicles this past quarter even with that factory shutdown — an increase over its first quarter pace of 88,000 cars delivered but still below the company’s record of 112,000 in the fourth quarter of 2019. This helped the company generate $6 billion in revenue, buoyed by $370 million in energy storage sales and $487 million in services revenue.

Elon Musk has promised that his company will deliver 500,000 vehicles by the end of 2020, and the company maintains that is still possible. Tesla says it’s installing “additional machinery at the Fremont Factory, which is expected to increase total Model 3 / Model Y capacity from 400,000 to 500,000 units per year.”

Tesla’s quarterly revenue and profit/loss

(billions in USD; green indicates profitable quarter)

Tesla once again wasn’t purely profitable based on its sales, though, as it also sold $428 million worth of regulatory credits in the quarter, an increase over the $354 million in credits it sold during Q1 of this year (and a record for the company). Its overall revenue was down year-over-year, thanks in large part to the pandemic. And yet the company’s run of profitable quarters may now put it in the vaunted S&P 500.

The company’s stock price is sure to rise as a result (it is up sharply in after-hours trading), continuing an incredible run over the last few months that has seen it rebound from a low of around $360 per share to now well over $1,500. That run — which has been fueled by unprecedented stock market activity, optimism about the newly released Model Y, and a swirl of other factors — has made Tesla the most valuable automaker in the world.

Tesla’s success in the second quarter of this year didn’t come easy. CEO Elon Musk fought a very public battle with local officials over the stay-at-home order that was put in place to slow the spread of the novel coronavirus. He ultimately reopened the Fremont factory in violation of that order. “If anyone is arrested,” he tweeted in May, “I ask that it only be me.”

Much like other automakers and factory operators around the country, Tesla has dealt with COVID-19 infections at its facilities. Employees have spoken publicly — some even on the record, despite Tesla’s history of retaliation against whistleblowers — about the cramped conditions that they’ve had to work in, which seem to grate with the detailed “return to work playbook” that the company released in May. Multiple workers at the Fremont factory have tested positive for COVID-19, though the company disputes exactly how many and says fewer than 10 contracted the novel coronavirus while at work.

If Tesla can keep COVID-19 from spreading through its workforce, and it doesn’t have to deal with any further shutdowns — neither of which are a given — it could be in for a very strong second half in 2020. It was able to deliver 122,000 cars in the final quarter of 2019 without the new factory in Shanghai, China (which came online at the beginning of this year) or the new Model Y SUV (which started shipping in March). Tesla is also working on more powerful versions of its older Model S and X vehicles that could break cover by the end of this year. While the company isn’t on pace to hit its target of 500,000 deliveries in 2020 based on the first two quarters, that could change quickly if all of these factors come together.