The frenzied real estate market over the last two years has been challenging for many homebuyers, but for those who have been able to buy, the return on investment has been strong. Homes are appreciating at a record pace, with sale prices rising around 20% from 2020 to 2021.

With these rapid increases in home values that can be seen in property press online, some investors are looking to rental properties as a source of potential returns. While many of those capitalizing on the current state of the market are institutional investors, the current market conditions could present opportunities for small-scale investors as well. However, these would-be landlords must assess how rapid shifts in the value of real estate could affect their investments in the short and long term.

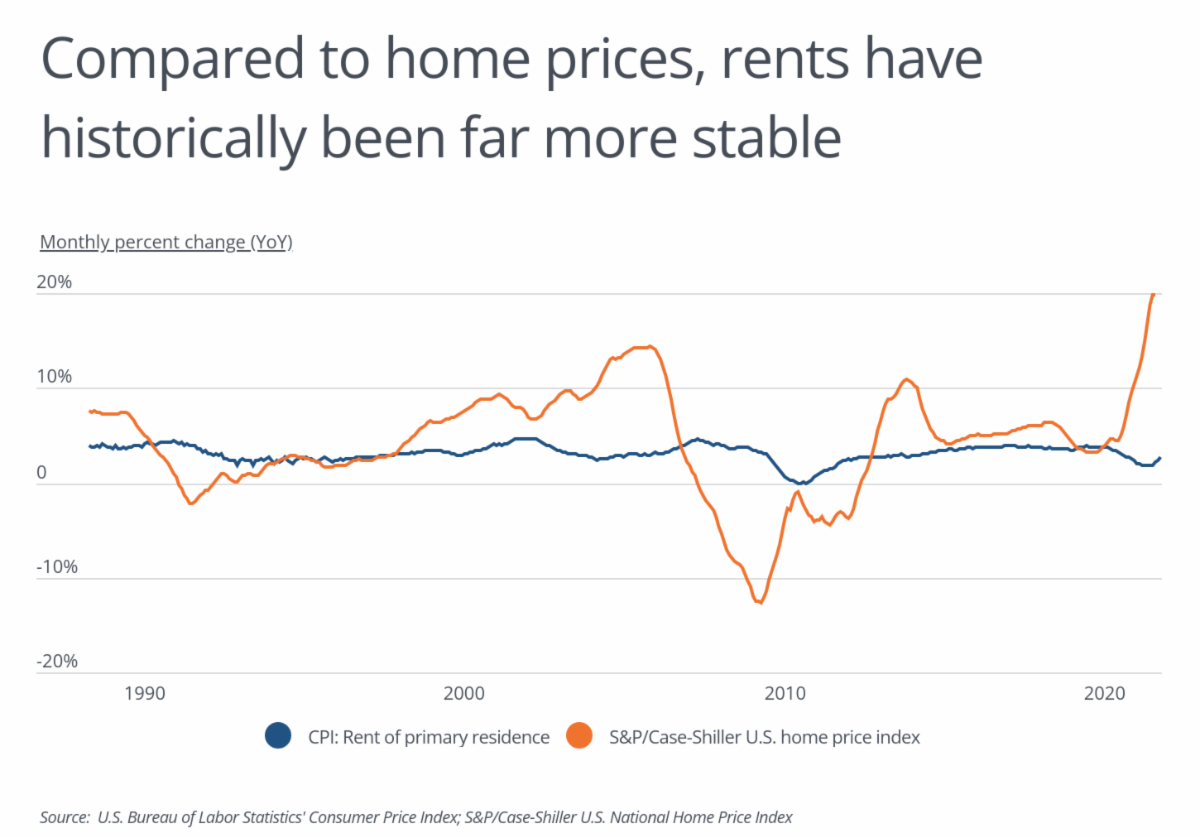

Increasing home prices have been a major story since the pandemic began, but home prices have shown a fair amount of volatility over time, especially in comparison to rent. For example, prices rose at a fairly rapid pace during the real estate bubble of the early to mid-2000s but collapsed when the bubble burst. Home prices then had an uneven recovery until the recent spike beginning in 2020. For rents, meanwhile, the rate of growth year-over-year has held steady between around 2 and 5 percent outside of a dip during the Great Recession and over the last year or so.

The relative stability of rents compared to the current rise in home prices will affect how potential real estate investors assess properties. As sale prices increase, the initial investment and ongoing costs increase as well, which can limit the investment’s cash flow should rents fail to keep pace. On the other hand, rapid appreciation in home values can increase the investor’s overall return when the property is eventually sold with the help of thepropertybuyingcompany or other agencies.

One example of how home prices can shift an investors’ calculations is the gross rent multiplier, which is a common indicator that investors use to gauge the quality of an investment. Gross rent multiplier is a ratio calculated as the price of a real estate investment divided by the gross annual rental income. Investors usually view a lower ratio as a good investment because it means that the rental income will more quickly recoup the cost of the property. When the investment price rises, the multiplier does as well.

How To Invest In Commercial Real Estate Without Spending Millions

Another example is property taxes. All else being equal, rising home prices translate into larger annual property tax burdens, and thus reduced cash flow. Fortunately, property tax rates vary widely by location, and in many parts of the country, existing owners are paying effective rates of less than 1%.

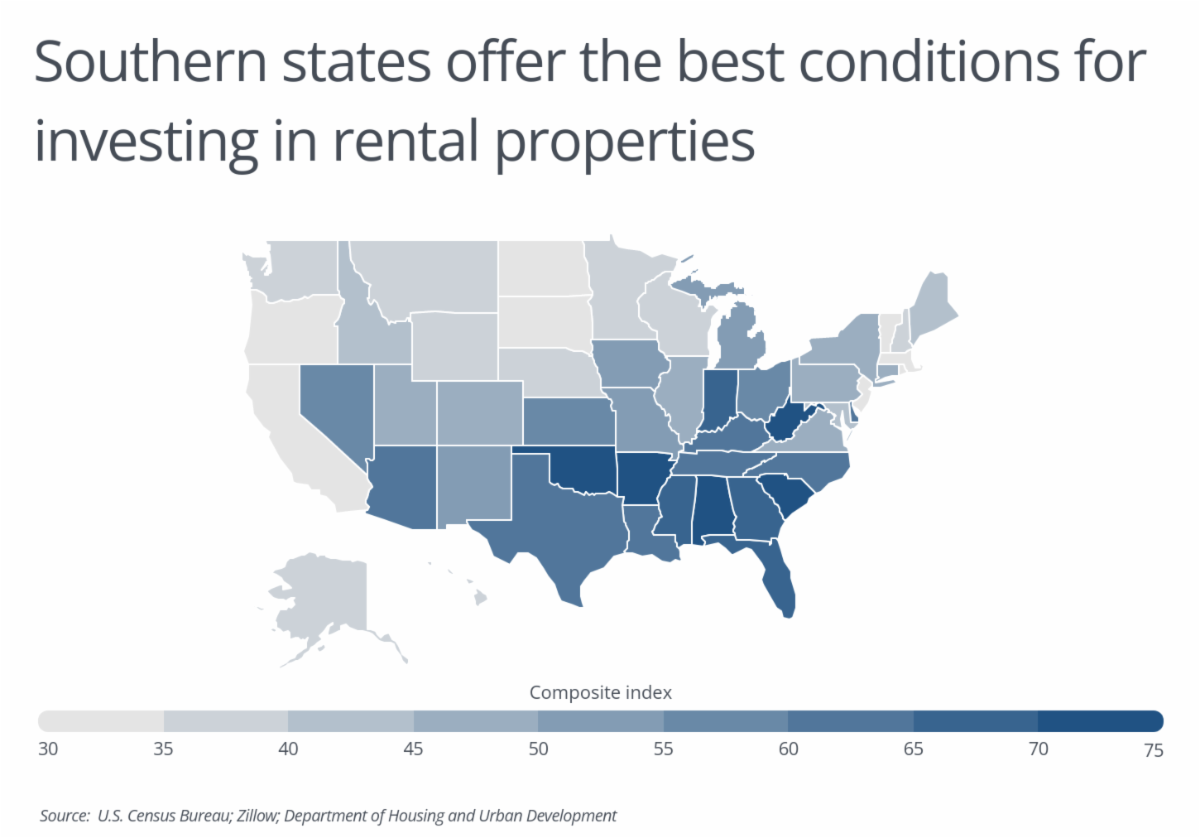

This collection of factors can help real estate investors hone in on the best locations to make an investment. Markets that have a low gross rent multiplier, low property taxes, and a positive outlook for future property value growth offer the best mix of conditions for a potential investor. A quantity surveyor can save you a lot of tax by calculating tax Depreciation. In the U.S., most of those locations are found in the South. Southern states tend to have some of the lowest housing prices and lowest property taxes of any region, but the region is also seeing some of the fastest growth in the country, which will boost property values as more people seek housing.

To identify the best locations for buying a rental property, researchers at Stessa created a composite index based on five key factors real estate investors consider when evaluating a market. These factors include the gross rent multiplier, recent and forecasted home price growth, effective property tax rates, and population growth.

Data sources include the U.S. Census Bureau, Zillow, and the Department of Housing and Urban Development. To improve relevance, only locations with available data from all sources were included in the analysis.

The analysis found that in Texas, the median home price experienced a change of +19.3% and is now $262,820. Taking this and the aforementioned factors into account, Texas is the 11th best state to buy a rental property in the United States. Here is a summary of the data for Texas:

- Composite index: 64.51

- Gross rent multiplier: 16.7

- Median monthly rent: $1,314

- Median home price: $262,820

- Year-over-year change in home price: +19.3%

- Forecasted home price growth: +17.8%

- Effective property tax rate: 1.60%

- Year-over-year change in population: +1.3%

For reference, here are the statistics for the entire United States:

- Composite index: N/A

- Gross rent multiplier: 17.9

- Median monthly rent: $1,435

- Median home price: $308,220

- Year-over-year change in home price: +18.4%

- Forecasted home price growth: +13.6%

- Effective property tax rate: 1.03%

- Year-over-year change in population: +0.4%

For more information, a detailed methodology, and complete results, you can find the original report on Stessa’s website: https://www.stessa.com/blog/