The foreign exchange market. If you haven’t heard about it, then you probably haven’t been reading much into economics for very long! It’s been called many things by many economists. Some call it a bad thing. Some call it a get-rich-quick scheme. As with many subjects that are called either of these things, it’s not quite as easy as one or the other.

Maybe you’re a potential investor. Maybe you’re simply an everyday citizen trying to get their head around certain economic concepts. Whoever you are, trying to get your head around foreign exchange, or currency trading, is worth your time.

What is the foreign exchange market?

You may have heard it referred to as the forex market. Maybe you’ve heard it referred to as currency trading. Either way, the foreign exchange market is, at its most basic, a fairly easy concept to grasp. It’s a financial market in which different currency of the world is exchanged. Pretty much all currencies are in action. The currency of one country will be traded for another, based on the traders’ belief in the future value of those currencies.

Ever had your national currency exchanged for another country’s currency for holiday purposes? Then surely you’ve noticed that the values of these currencies fluctuate. Let’s say you’re in America, have 500 USD (United States Dollars – $500). You want to go to the United Kingdom with the equivalent of that in GBP (Great British Pounds). At the time of writing this article, that 500 USD would get you approximately 354 GBP (£354). But a couple of years ago, that may have been 360 GBP. And maybe next year it will be 358 GBP.

This is why a store that offers such a service will have a board showing exchange rates. Notice how those boards are digital so they can change at any time? That’s the fluidity of foreign exchange on display. In these examples, it’s just a few dollars or pounds here and there. But on a large scale, and over many currency exchanges, people stand to make or lose millions.

There isn’t a physical, centralized place where this occurs. Instead, it takes place globally, in disparate places and times. According to historical records, foreign exchange has been occurring since ancient times. In the early- to mid-seventies is when it really started to take off. The gold standard, to which the value of money was always commensurate, was abandoned on a wide scale. Richard Nixon had the United States abandon it in 1971. There was also freer market conditions, cheaper global travel, and easier global communication. With the actual value of any given currency now more fluid than ever, this all combined to light a fire underneath the foreign exchange market. (I mean the kind of fire that makes you jump up and take action. Not the kind that destroys you. Basically, the forex market took off in a big, big way.)

Currency trading is now largely done via electronic communication networks, as well as phones. Today, it’s the largest financial market in the entire world, with around $1.5 trillion traded every single day.

All day and all night: the almost-24-hour market

If you’ve ever dabbled in the stock market – or seen a film set on Wall Street – you may know that the stock market isn’t always open. Different stock markets around the world have specific opening and closing times. Some of the stock markets, like the Tokyo Stock Exchange, even have lunch hours in which they don’t operate. Look at the New York Stock Exchange opening and closing times, for example. Investors have to take into account national holidays, as well as the daily opening times, when they make exchange decisions.

Not so with the foreign exchange market. This market is a 24-hour market. Think that there’s a high demand for stock? Well, think about it. How do you acquire stock? With currency. (Well, and other things. But mostly currency.) And currency doesn’t just acquire stock; it acquires, well, everything. The demand for currency is international, non-stop, and insatiable. With economic and political instability worldwide, the economy of any given country is always going up and down. By trading their currency on the open exchange market, countries hope to keep up the value of their currency relative to that of others.

So the political and economic stakes are very, very high. Not only that, but we have the Internet, phone lines, and millions of people speaking several languages. There’s also the fact that the market isn’t centralized. There is, in short, very little reason for this market to be closed at any given time. Nor, in fact, is there much ability to do so.

The foreign exchange market can be split into four different “sessions”. Between Sunday at 5pm (EST) until Friday at 4pm (EST), these markets are open and active, though at varying times to one another. These market sessions take place in New York, Tokyo, Sydney and London. The Sydney market is open from 5pm to 2am. Tokyo is open from 7pm to 4am. London is open from 3am to 12pm. New York is open from 8am to 5pm. (Please note that all of these given times are EST!) So, if you look at all these times, you can see that there’s a 24-hour window in which the markets are active. There are even times when active markets overlap, which are seen as the real exchange hot-spots.

So why was this section titled almost 24-hour? Well, many of those specific markets close on weekends. One or the other is still open for most of the weekend. But there is a lengthy gap of activity. In EST, this can encompass the whole of Saturday. There are also pockets of non-activity from official markets during Easter holidays and New Year’s Day. This doesn’t mean the foreign exchange market closes, however. While it’s not “officially” open, after-hours trading is always a possibility. Currency values become more volatile during these hours, however. Amongst other possibilities, this makes after-hours trading a bit risky.

How do I get involved?

Getting involved in the foreign exchange market is pretty easy. Your first step should be making sure you’re financially able to do it. And when I say that, I don’t mean “Do you have money? Then the answer is yes!” Sure, you have money. But does that money have a use? Do you need to pay off debts? Put your kids through college? Pay for medical treatment? You should not use any money that you need to use for something specific. Be very, very clear about that. You don’t want to gamble, here. You want to take surplus money that you planned on using for capital expansion anyway. It may be money that you were planning to put into stocks. Stocks are great for investment, but you may want to get some experience in currency exchange first.

You ready and able? Then you need to get a forex account. This is otherwise known as getting a forex broker. You may think you can do it without this form of external help. But don’t get cocky! A forex account provides the platform you need to get currency values in near real-time. Emphasis on near. It’s nigh-on impossible to get currency value changes in real time. Getting them in near real-time is difficult enough, so you need a forex account to ensure you even get that!

It also keeps you within certain regulations. Compliance with regulations are extremely important in forex trading. Staying within certain boundaries can be very difficult to do unless you’re operating through a forex account. This doesn’t apply just to, for example, the economic laws of a given foreign country. There’s also personal ethics or religious boundaries to consider. Let’s take Islam as an example. Let’s say you have a regular forex account. Several parties (including yourself) stand to profit with futures contracts, swap rates and arbitrage. It may not be entirely clear 100% of the time that this is occurring. If you are a Muslim, this can create problems for you. The practices mentioned are not considered halal by Islamic scholars. This is why it’s important for a follower of Islam to look into brokers who provide Muslim accounts. This helps an individual stay compliant not only with international law, but also with the strictures of their faith.

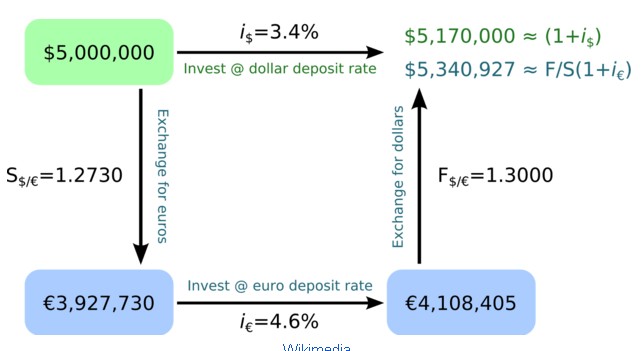

You also need to get to grips with the financial lingo, as well as the world’s economic happenings. As a beginner trader, for example, you need to understand arbitrage. Arbitrage is the purchasing of currency from one market followed by the use of that currency to buy the currency you started with. Exchange rates across three currencies can result in profits. Let’s say you have 5000 USD. At a given time, the exchange rate between pesos and reals is higher than that of reals to dollars. You can use the dollars to purchase, say, 100,000 Mexican pesos. Then you use those pesos to buy 40,000 Brazilian reals. You then use those reals to purchase 5100 USD. Congratulations! You just made a profit of $1000. You should understand that the time limit in which such a profitable triangle is possible is usually very small. This is another reason you need a forex account – it allows you to track arbitrage opportunities.

This article has been but a brief primer. Get yourself a forex account, read up on the risks, and stay up-to-date on the world economy. It could pay off big time!