Proceeds of Sale to be Used to Advance U.S. and Overseas Projects and Strengthen Balance Sheet

FT. LAUDERDALE, FL / ACCESSWIRE / July 28, 2021 / Kaya Holdings, Inc., (“KAYS” or the “Company”) (OTCQB:KAYS), the first U.S. publicly traded company to hold and operate state-issued “touch-the-plant” licenses for the retail, cultivation and production of cannabis, announced today that it has concluded a settlement with Sunstone Capital Partners, LLC, Sunstone Marketing Partners LLC and Bruce Burwick, regarding the failure to deliver to KAYS the Oregon Cannabis Production and Processing Licenses (who are well known for their sales of jars for weed across the country) that were part of the original warehouse purchase transaction in August 2018.

Pursuant to the terms of the settlement, Bruce Burwick, the principal of Sunstone surrendered to KAYS 1,006,671 shares issued to him in connection with the transaction (800,003 shares for the facility purchase, 166,667 shares which were issued for $250,000 in cash and 40,001 shares issued as annual compensation for Burwick serving as a director of KAYS). The shares have been submitted to KAYS’ transfer agent for cancellation. In addition, the Company received clear title to the warehouse facility, which enables the Company to sell it without restriction.

As part of the settlement, Burwick received $160,000 from the net proceeds of the sale of the facility’s grow license to an unrelated third party, resigned from the Company’s board of directors and agreed to work as a non-exclusive consultant to the Company for the next four years for a yearly fee of $35,000.00.

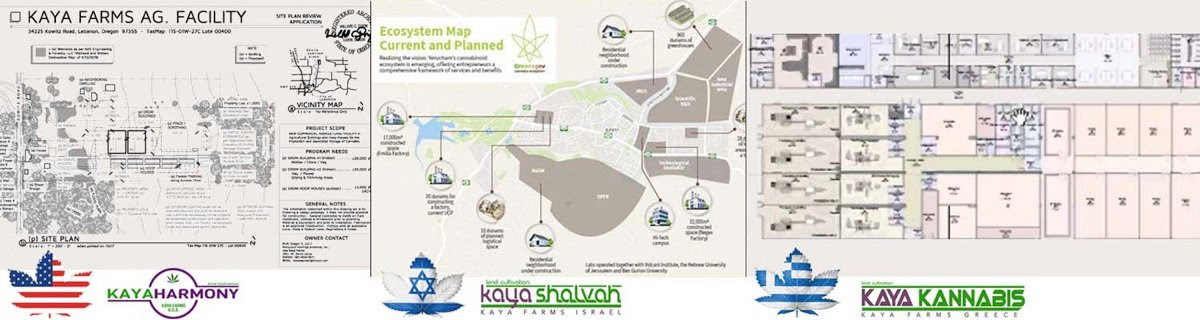

“Now that the settlement has been concluded, we have engaged a seasoned commercial property broker to list the property,” stated Craig Frank, KAYS CEO. “We intend to use the proceeds of the sale to propel progress in our U.S., Israel and Greece, as well as improve our balance sheet. Projects we plan to focus on include launching Kaya Harmony™ – Kaya Farms™ U.S.A., introducing a number of consumer product brands, redesigning our Kaya Shack™ stores, launching CBD brands in Europe, and acquiring land in Israel through an Israeli government tender program.” “These steps,” concluded Frank, “will position us to increase revenues, lower our cost of goods, and allow KAYS to further implement our global expansion plan.”

22RedLA CEO, Harry Kazazian Is Bullish On the Cannabis Industry and High on Success

“I am very pleased to assist with implementing the settlement and look forward to seeing the subject property sold and the funds received by KAYS,” commented W. David Jones, Senior Advisor to the Company. “If the Company completes a sale of the facility near the targeted price of $1.625 million (which is supported by comparable industrial property sales of like properties in the area), we would see a cash influx of up to $0.10 per share, while at the same time reducing the number of shares outstanding by 6.4%. This type of negative-dilution, increased cash reserves event is highly unusual, and we would hope the Market will recognize it appropriately.”

New Logo & Website

In addition to the foregoing, KAYS is pleased to announce the unveiling of its new corporate logo and launch of the new Kaya Holdings corporate website ( www.kayaholdings.com ). The Company’s new logo and website provide an improved representation of our team, operations and global expansion plans, as well as an enhanced investor portal.

including Kaya Harmony (Kaya Farms Oregon), Kaya Shalvah (Kaya Farms Israel)

and Kaya Kannabis (Kaya Farms Greece).

About Kaya Holdings, Inc.

Kaya Holdings, Inc. (OTCQB:KAYS) is a veteran U.S cannabis company with the historical distinction of being the first U.S. publicly traded company to hold and operate state issued, “touch-the-plant” licenses for the retail, cultivation and processing of cannabis.

Our operating philosophy is simple: consistently provide high quality cannabis products at fair prices in a friendly and convenient environment to a diverse group of customers.

Our strategic philosophy is patience: as Steven Wright so accurately pointed out, “the early bird may get the worm, but the second mouse gets the cheese”. We started in 2014 as the industry’s public pioneer and are pleased to have that distinction. Relying on our tendency toward patience, we elected to take the time we needed to successfully navigate a transitioning, highly regulated, massively hyped, growing and complex global industry, working toward establishing the fundamentals to support a global cannabis enterprise at a reasonable and sustainable cost. Our patience is paying off and we have launched our global effort, with initial projects in Greece and Israel.

Our business philosophy is proactive: while cultivating the right global opportunities built and mastered the essential cannabis fundamentals including commercial scale cultivation and extraction/infusion, strong brands, exciting retail, distribution channels, and access to technology. Now that the time to grow has arrived, we are rapidly acting to secure strategic global positions, measured capacity, penetrating distribution and qualitative/quantitative technology driven competitive advantages.

Important Disclosure

KAYS is planning execution of its stated business objectives in accordance with current understanding of state and local laws and federal enforcement policies and priorities as it relates to marijuana. Potential investors and shareholders are cautioned that KAYS and MJAI will obtain advice of counsel prior to actualizing any portion of their business plan (including but not limited to license applications for the cultivation, distribution or sale of marijuana products, engaging in said activities or acquiring existing cannabis production/sales operations). Advice of counsel with regard to specific activities of KAYS, federal, state or local legal action or changes in federal government policy and/or state and local laws may adversely affect business operations and shareholder value.