What would Warren Buffett do? Definitely not this.

But that didn’t stop Ryan Cohen — who sold Chewy CHWY, 0.31%, the company he co-founded, for $3.35 billion back in 2017 — from throwing diversification out the window and plunking almost his entire payout into just two stocks: Apple AAPL, 0.31%, and Wells Fargo WFC, 4.75%, two major components of Buffett’s Berkshire Hathaway BRK.A, -0.34% portfolio.

“It’s too hard to find, at least for me, what I consider great ideas,” he told Bloomberg News, without specifying exactly how much he invested. “When I find things I have a lot of conviction in, I go all-in.”

No real estate. No hedge funds. No private equity. No bonds. The same car and home he’s had for years. The rest? “All-in” on Apple and Wells Fargo. Against all conventional wisdom.

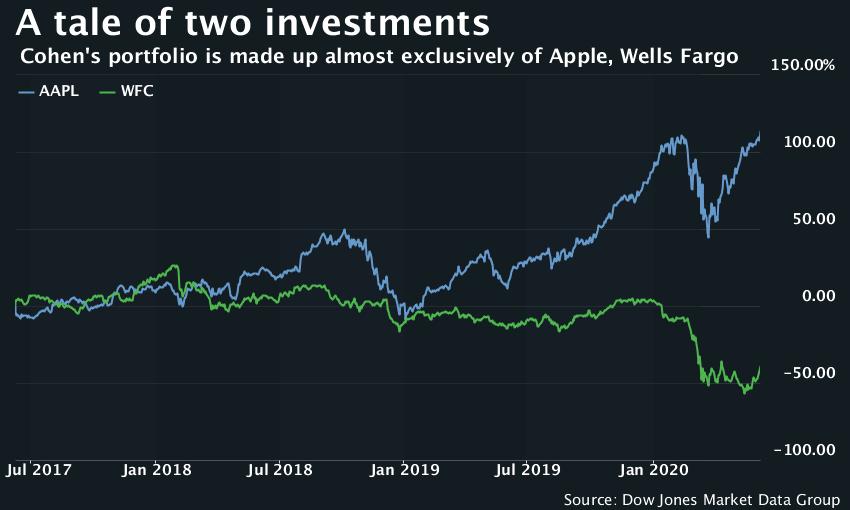

It hasn’t exactly been a smooth ride, at last for the latter position. He told Bloomberg News that his average cost basis in Wells Fargo is about $46, having built up his position in the second quarter of 2017 when it was trading at $54. Now, the stock is trading below $32.

On the flip side, Apple is doing just fine. It rallied 120% over the time frame and represents a much larger chunk of Cohen’s portfolio. Combined, his two positions, according to Bloomberg calculations, have been flat for the past two years to lag the S&P 500 SPX, 0.75%.

Nevertheless, Cohen, who never went to college, is a fan of Buffett, whom he quotes often. He knows, however, that his highly-concentrated approach would raise plenty of eyebrows among the “diversify!” crowd. But “I don’t want to swing for a single,” he said.

Cohen recognizes most people shouldn’t follow his lead. “You need to have the temperament to block the noise,” he told Bloomberg. “Sometimes it feels like a roller coaster.”

Meanwhile, the stock market keeps charging higher, with the Dow Jones Industrial Average DJIA, 1.14% building on last week’s strong finish with a premarket rally Sunday night.