Private-equity firms typically accustomed to gobbling up large companies have been going after smaller businesses instead, in part due to “a cloudy economic outlook.” The average value of private-equity deals so far this year sits at $65.9 million, or the lowest it’s been since the start of the 2008 financial crisis, reports The Wall Street Journal. Higher-priced buyouts are trickier because borrowing costs are up and the murky economic outlook makes it harder to put a value on businesses. This is driving “buyout giants” like Blackstone and KKR to use their record cash piles for smaller deals.

- The overall value of PE-backed deals has dipped more than 50% in 2023 to a three-year low of about $256.7 billion, per Refinitiv data.

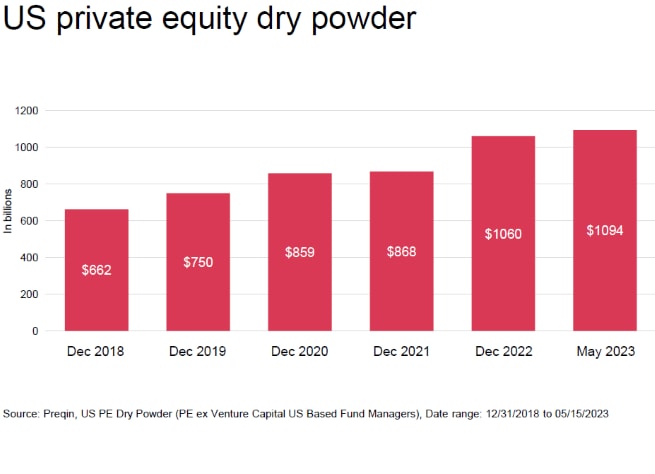

- Private-equity firms have $1.4 trillion worth of dry powder (investor cash awaiting allocation) to spend on deals, notes the Journal.

By Jessy Bains, Editor at LinkedIn News

Private equity: US Deals 2023 midyear outlook

Private equity embraces new investment strategies

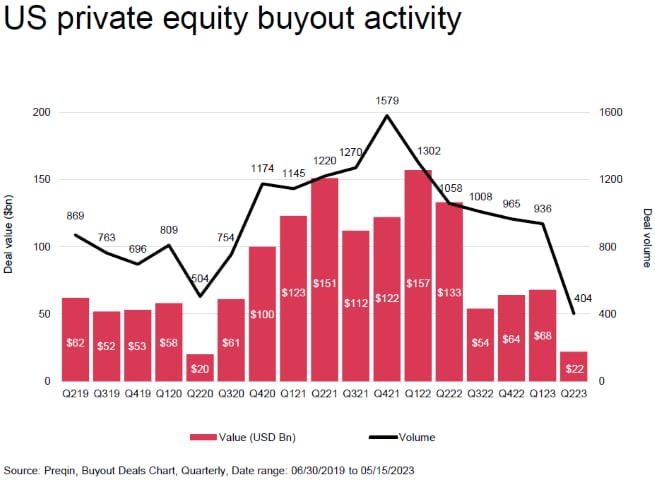

The start of 2023 has seen a continuation of 2022’s significant slowdown in PE-related deal activity as buyers and sellers navigate ongoing macroeconomic turbulence, challenging debt markets and global geopolitical uncertainty. Over the past year, PE-related deal volumes have declined ~30% (Q1 2022 to Q1 2023), taking the market back to pre-COVID levels. However, while volumes continue to fall, aggregate deal value has ticked up modestly each quarter since the post-COVID plunge, reflecting opportunities to get deals done given the right asset, strategy and value-creation plan. These opportunities are most prevalent in segments with broader market tailwinds, such as infrastructure and renewables (with significant boosts from the IRA) and healthcare, where new waves of innovation continue to drive activity.

We expect deal scarcity to remain as long as buyer and seller expectations on valuations remain mismatched. While we see some early signs of a narrowing of the gap, there’s a long way to go before large platform investments reach 2021 levels.

To win in this challenging environment, private equity firms must adapt in response to both the acute conditions on the ground and longer-term trends that continue to rise on investment committee agendas, such as talent, digital transformation and ESG.

A renewed emphasis on integration for a core PE Play

Platform building remains a key component of most PE strategies — but even experienced investors and operators face challenges in delivering on the potential of bolt-on and transformative acquisitions. In particular, our survey finds concerns around fully capturing cost savings, delivering on any revenue synergies and, in particular, managing culture and team dynamics through transactions. There is significant benefit to building out M&A capabilities early in an investment, to maximize the value realized through the life of the platform.

Learn more about leading practices and transformational mindsets in PwC’s new M&A integration report.

Opportunity amid uncertainty

The current period of uncertainty in global markets and economies is driving a sustained bout of introspection among large public companies, with many considering large carve-out, spin-off or take-private transactions. These actions have multiple aims, including a need to maximize strategic focus, prune underperforming businesses, transform core businesses and, in some cases, raise cash.

PE investors have been significant beneficiaries of this trend, with take-private and carve-out transactions being a bright spot in the first few months of 2023.

We see continued opportunity for PE to pursue major acquisitions in this environment. The most successful investors will be those who are proactive in identifying actionable public targets (those with sound fundamentals but which are non-core or face near-term headwinds), developing a compelling value creation strategy and bringing differentiated capabilities spanning talent, digital and strategy to execute on the deal.

While PE deal volume continues to drop, value is slowly recovering, and significant dry powder reserves suggest potential for significant activity as conditions improve.

Instead, private equity firms must now embrace portfolio company value creation as the primary mechanism for growth, with a particular focus on digital and talent transformation in addition to driving ESG initiatives to position their investments for sustainable development.

In addition, PwC’s recent divestiture study found that timely execution of divestiture decisions can help provide capital for reinvestment into core operations. Given the challenges of the current economic environment, more companies may embrace divestitures as part of their transformation process — which could lead to targeted opportunities for PE.

Capital allocation

Growing LP preferences for more diversified portfolios and the current slowdown in traditional buy-out opportunities will likely push private equity firms (particularly megafunds) into developing additional vehicles beyond their traditional core buy-out funds. Major areas of focus will include infrastructure and real estate, given both significant capital deployment opportunities and relatively predictable returns as well as novel fund types focused on ESG driven by strong LP interest. At the same time, novel vehicles supporting the entrance of retail investment dollars into private capital will continue to buoy overall capital pools.

In addition, rising interest rates and overall capital concerns from banks have created an opportunity for large private equity firms to offer private debt financing to facilitate deals, both their own and their rivals.