Aurora Cannabis (ACB) investors are a resilient lot. The Canadian cannabis producer is notorious for diluting its shares via cash raising efforts. The company has continually burnt a hole through its reserves, and the share count has ballooned over the years as it has attempted to put the fires out.

Its latest move has involved another attempt to pad the coffers; On Thursday, the company announced a bought deal of $125 million, in which it has agreed to sell approximately 12 million units for $10.45 each. Within a 30-day period, the underwriters can also buy an additional 10% of the units. Should the warrants be exercised, the full dilution going by Thursday’s closing price would be 9%, and could reach 9.8%, should the additional 10% option be exercised.

So, further bad news for shareholders? Actually, not so, says Jefferies analyst Owen Bennett.

“We welcome this after flagging a risk of underinvestment following the recent business update,” the analyst said. “Since then, US political developments also mean the US market could open up sooner rather than later. ACB will certainly need cash to establish a US foothold, yet we still wonder if this is enough.”

Cannabis companies, like those who sell potent delta 8 flower and CBD balm stick, have opened the year on the front foot as investors have banked on President Biden and the new U.S. administration plowing ahead with federal marijuana reform. The move could open the door for the Canadian LPs to enter the lucrative U.S. market. As a result, shares of Aurora are up by a massive 125% over the past 3 months, and Bennett has pondered whether the share gains have been justified.

The favorable legislation, he says, will mostly benefit local U.S cannabis companies selling CBD “unless a Canadian name has the ability to establish a strong US presence.”

Can Aurora be one of these? The analyst is doubtful.

“Aurora’s balance sheet rules out acquiring US assets unless it issues shares at a material dilution,” Bennett summed up, “So while the additional cash is encouraging, we do wonder if still too little to really get a strong US CBD and THC presence.”

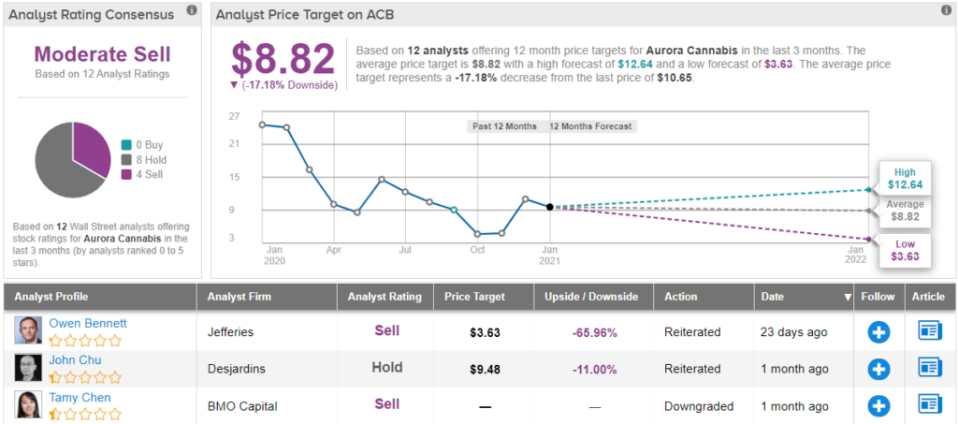

There’s no change, then, to Bennett’s rating which stays an Underperform (i.e. Sell). Going by the CA$4.59 ($3.63) price target, Bennett expects shares to slide by a painful 66% over the next 12 months.

The Jefferies analyst is not the only Aurora pessimist. The stock has a Moderate Sell consensus rating based on 8 Holds and 4 Sells. While not quite as bearish as Bennett’s forecast, the projection is for downside of 17%, given the average price target currently stands at C$11.17 ($8.82).

To find good ideas for cannabis stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis on THCv gummies and other cannabis products before making any investment.