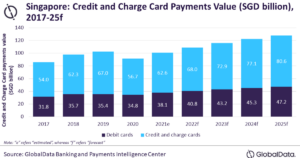

Credit card spending in Singapore is expected to continue to rise in 2023, despite concerns over increasing debt, reports The Straits Times. Market players observed the following trends:

- Spending was up 30 percent in 2022 compared to 2019: Citibank Singapore.

- Spending on transport and online shopping grew by 40 and 20 percent respectively: DBS.

- 60 percent of credit card spending were made by individuals aged 31-50, who typically make big purchases such as home-related expenses and children’s education: OCBC.

However, with the economy slowing down and interest rates at their highest in years, there are worries about the potential impact of credit card debt.

Credit card debt is one of the easiest types of debt to accumulate and one of the most difficult debts to pay off

Consumer credit card spend often serves as a barometer of consumer confidence in the state of the economy. The healthy growth balanced with controlled indebtedness as evidenced by the market players including OCBC augurs a generally positive outlook for our economy.

Credit to our financial regulator’s prescient measure of the progressive implementation of the balance-to-income (BTI) between 2015 and 2019, BTI has proven to be a most effective check against unbridled growth of consumer unsecured debt in Singapore and guardrail to facilitate the balanced growth of consumer credit.

Earlier this month, I shared with Khieng Yuit Chor some observations about credit card spend. Since the pandemic, credit card spend has been on the rise every year. In 2022, the amount of money our customers spent on their credit cards increased by 16% year-on-year. Unsurprisingly, about 60% of total credit card spend were made by those aged 31-50, a demographic traditionally associated with expense-heavy demands such as home-related purchases and education for their children.

The top 3 most common spend categories in 2022 were dining, groceries and insurance, which made up 35% of the total credit card expenditure. Interestingly, there had been a 25% year-on-year growth in card spend on fast food restaurants since 2021.

We expect credit card spend to continue growing as people seek a return to their pre-pandemic lives, with the resumption of global travel and the trend of revenge spending.