When you’re an amateur investor, the stock market seems akin to a fattened sow, ripe for slaughter. Well, if you’re not too careful, you may end up losing a fortune.

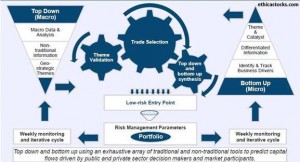

So, how do you make smart investments if you’ve decided to start investing today? Simple, you first pick a strategy that suits your needs. Two popular methods of stock-picking happen to be the top-down approach and the bottom-up approach. Click here for a full guide in choosing a stock picking service. As contrary as they are, both these investment perspectives ultimately aim to do the same thing—find the best stocks on the market.

The easiest way to comprehend these techniques is by contrasting the two.

Top-Down For The Bigger Picture

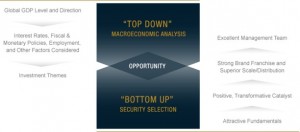

First, let’s consider the top-down approach. In this method of stock-picking, you begin your journey by initially gauging broader macroeconomic factors. Economic indicators, both domestic and international, take the highest priority.

By examining factors such as political conflicts, currency fluctuations, exchange rates, and inflation, top-down investors aim to gain a wider perspective of the global economy. They then narrow down their focus toward asset classes that are likely to benefit from prevailing conditions. After identifying these classes, a top-down investor further zeroes in on those few sectors that offer the best prospects. Continuing in this vein, the most favorable companies are then cherry-picked from those sectors.

Top-down investing involves a comprehensive analysis of market cycles and trends. For instance, say a top-down investor senses a steep decline in international oil prices well-beforehand. This then prompts him to invest heavily in those markets benefiting directly from the price fall. Consequently, he also sells the equities he owns in regions heavily dependent upon oil production.

After a while, his prediction turns out to be true and he ends up making a killing—that’s how top-down investors work.

But, how is it different from the bottom-up approach?

Bottom-Up For Individual Attention

Just as the top-down approach begins with gauging broader macroeconomic factors, the quintessential bottom-up investor begins by examining individual stocks. A bottom-up investor is more interested in a company’s fundamentals than in surrounding market trends. Proponents of this approach have, many a time, stumbled upon hidden gems.

Take the case of Facebook for example. Agreed that the high profile IPO was not a huge success and the company was not able to monetize its mobile user base at that time. However a strong user growth post going public coupled with successful monetization and strategic acquisitions has seen the stock do well as is evident from Facebook stock chart.

Warren Buffett, one of the world’s greatest investors, is predominantly a bottom-up investor who thoroughly analyses the fundamentals of each company before investing in it.

Choosing Your Own

It is important to remember that both these investment approaches have their own shortcomings. Although a top-down approach can help you find the best sectors worth investing in, it can’t really help you find the best companies within that sector to the degree that a bottom-up approach can.

It would be wise to say that top-down analysis is best-suited to finding the most promising sector, while the bottom-up approach is more effective when it comes to gleaning out the best individual companies.

Essentially, you don’t need to restrict yourself to either approach. Using the information at hand, you can find the best sector using top-down analysis, and then use the bottom-up approach to determine the best company within your chosen field. You may also get assistance from the best PMS in India.

But above all, it’s critical that you choose a long-term investment plan that combines high returns, lows risk, and financial flexibility.